- Pros

Excellent user experience. Clear navigation. Comprehensive coverage of tax topics. Top help tools. Thorough return review.

- Cons

Lacks linear navigation wizard and all-in-one step-through of topics.

- Bottom Line

H&R Block Deluxe is a comprehensive, easy-to-use tax service that helps e-filers claim relevant deductions and credits. The site is much improved, both in terms of the user experience and help options. It's our top choice for online tax preparation.

H&R Block provides more options for personal tax preparation than any of its competitors, including in-office services, DIY software, and online applications. The company also offers a hybrid of DIY and professional prep, called Tax Pro Review. We tested H&R Block Deluxe, which looks and works much like the other personal tax software in H&R Block's lineup. The Deluxe edition focuses on W-2 and interest/dividend income and supports the Schedule A, so you can see whether itemizing this year is better than taking the doubled standard deduction. H&R Block Deluxe offers the most capable blend of tax topic coverage, usability, and taxpayer guidance, all of which earn it our Editors' Choice for online tax preparation services.

Download H&R Block 2018 - 2019 Tax Software. The H&R Block download and CD tax software versions can be accesses through their website at hrblock.com where you can.

- $47.95

- $6.99

- $0.00

- $109.95

- $29.95

- $59.99

Like an Office Visit

If you've ever sat in a tax preparer's office, you've probably noticed that they know what questions to ask—and in what order. Online personal tax preparation websites like H&R Block Deluxe work similarly—minus the human interaction. You don't see graphical representations of tax forms as you work. Rather, these sites use wizardlike tools to display their questions. When you supply an answer, the software works in the background to do the required calculations and fill in the official IRS forms and schedules.

How To Download Hr Block Software Windows 10

As you advance through the wizard, you can track your progress through both occasional summaries of your work so far and real-time dollar figures representing what you owe or are owed at that point in the process. Help is available in a variety of ways. If you don't understand a particular query, you can click links for more detailed explanations. The best services never expose you to the sometimes-complex language the IRS uses in its instructions. Instead, their tax experts rewrite the official texts with the average taxpayer in mind. Since you almost never interact directly with the tax forms, the software can hide the fact that filing your taxes didn't get simpler this year.

After you exhaust all the topics that apply to your financial situation, these websites do three things. They review your return and show you any problems they found, which you can correct. They transfer applicable data to any state returns you must file. They also walk you through the process of actually e-filing or printing your return. You can do everything up to this final step without paying the fees required.

Speaking of fees, there are four sites in H&R Block's main lineup: Free (both federal and state, supports the Form 1040 and situations like child care expenses, student loan interest, and Social Security income but not the Schedule A, like it did last year); Deluxe ($29.99 federal and $36.99 per state); Premium, ($49.99 federal and $36.99 per state, adds Schedule C-EZ, D, E, and F), and Self-Employed ($79.99 federal and $36.99 per state, adds Schedule C and additional guidance for the self-employed). Tax Pro Review ($119.99 federal and $36.99 state) assigns you to a tax professional who then does a thorough review of your return.

These prices are significantly lower than those of TurboTax across the board, and close to TaxAct and Jackon Hewitt's pricing. TaxSlayer's $17 entry-level Classic plan is even more affordable, but if money is too tight to swing even that, Credit Karma Tax, offers completely free federal and state filing, and FreeTaxUSA is free for federal and $12.95 per state. Note, however, that with the free services you sacrifice quite a bit when it comes to hand-holding, which most of us end up needing at some point during the process.

Note that tax prep services change their prices frequently, and they tend to go up the closer you get to the filing cutoff date—a good reason not to be a last-minute e-filer. You may even be offered different prices for some services based on how you reach them online. The prices listed here are correct at the time of this writing, however.

Tax Prep Housekeeping

Before you start entering income and expenses, H&R Block Deluxe has some housekeeping to do. You'll need to supply names, addresses, birthdates, and Social Security numbers for everyone in your household who will be included on your return. If you used H&R Block last year, that information should be transferred over once you enter your user name and password and start moving through screens. You'll need to specify your filing status and answer several other questions about things like your citizenship status. There'll be more questions a little later on (after you've entered your W-2 information) about your profession, any foreign accounts of assets you may have, and your state of residence.

Income First

If you're using H&R Block Deluxe, you're likely to have income that was reported on a W-2 form. That's the first income-related question the site asks about. There are three ways to provide this information. You can upload a PDF, take a picture of it with your smartphone after H&R Block texts you a link to a secure site, or fill in the fields manually.

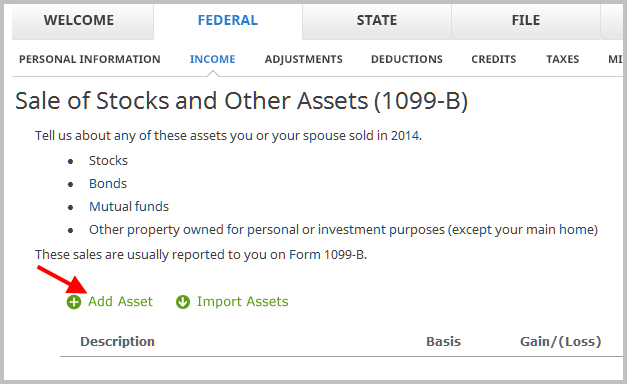

If you have other income, you then move on to a screen that lists every type possible, most of which are not supported in Deluxe. Click Business and Partnerships, for example, and you get a message saying that you have to upgrade to record this kind of income. You can, however, provide information about income like interest and dividends, Social Security, and 1099-R retirement distributions. H&R Block Deluxe lets you connect directly to many financial institutions to import this data.

To visit a specific topic (like Interest, Dividends, and Capital Gains Distributions), you click the down arrow to the right, which opens the list of subtopics covered there. In this example, you'd be dealing primarily with the 1099-INT and 1099-DIV. If you choose a subject area that isn't covered by your current version, a message appears with upgrade instructions.

Each subtopic has a Visit Topic button next to it. Click it, and a mini-wizard walks you through the Q&A for that tax item. You provide the information requested by clicking buttons to indicate the correct answer, entering information in fields, and selecting from lists of options. When you finish, H&R Block Deluxe opens a screen that recaps your activity up to that point. It displays a list of every topic you've visited and lets you revisit or delete any of them. At the bottom of the page, you can click the Yes button to indicate that you must return to the income home page to visit more topics, or the No, I'm Done button to see a summary of your responses (with your 2017 numbers for comparison) and move on to adjustments and deductions.

The rest of the tax preparation portion of the site functions the same way. H&R Block Deluxe presents a list of topics you might want to visit but gives you the option to visit others. After you've completed the Deductions section, you move on to Credits and Taxes, and finally, the Wrap-Up, where you can see a summary of your return and go back to change anything necessary. The site then transfers relevant data over to your state review and runs a review for that before you pay and file.

The H&R Block User Experience

By now you know that you advance from screen to screen by clicking the Back and Next buttons. You do this throughout the site, though there are other navigation options, too. You can, for example, click a tab in the horizontal toolbar at the top (Overview, Federal, and so on) to see its subsections (like Income, Adjustments and Deductions, and Credits). Directly below this is a list of the forms you've completed; click on one to return to it. You can use icons to move into other sections of the question-and-answer screens. Links in the left vertical pane show you your real-time, ever-updating tax obligation or refund and take you to housekeeping pages.

The entire site functions in this way. H&R Block Deluxe makes it clear on each page what action you need to take and where you need to go next. But it lacks a comprehensive navigation tool like the one FreeTaxUSA offers. It also feels choppier than TurboTax Deluxe's smooth, linear flow.

H&R Block is a little more formal in its language and looks than the friendly—even folksy—TurboTax, though it's improved its user interface since last year, made it more attractive and softer. It uses friendly, understandable language, and its navigation and data entry conventions should be familiar to most taxpayers. The two sites simply have different personalities. TurboTax is the human preparer who greets you with a big smile and makes some small talk as he or she goes along. H&R Block is a bit more businesslike. Both are effective approaches.

Handy Help

The Q&A format that online tax preparation solutions offer works well if there's always an option to have complex or unfamiliar concepts explained in more detail—without requiring you to open a giant help database and search for a term (though there's a place for that, too). It's critical for tax software to make context-sensitive help easily accessible.

H&R Block Deluxe does a great job here—even better than it did last year. In fact, the site has improved its overall guidance system by tightening it up, making it more easily accessible, and localizing it. It used to use pop-out windows to display explanations of hyperlinked words and phrases. This year, it's reserved the right vertical pane for this. The pane can be toggled on and off, and it doesn't obscure the working area of the screen as it did before. It's always stage right, and it's always displaying content-sensitive FAQs for the current page, like TaxAct does, only better. This is a major improvement, and I am glad to see it.

Download H&r Block Software Already Purchased

Take the home mortgage section, for example. The site explains on the first page what it's looking for and displays a hyperlinked 'What's a Second Home?' phrase. Click on it, and the right vertical pane displays text that spells out the answer in clear, understandable language. There's another link here similar to others sprinkled around the site on relevant pages: 'Find out how tax reform affected your home equity loan.'

At any point, you can also enter a word or phrase in the Search field in the right vertical pane. Actually, just enter a word, like 'energy,' and several suggested topics will appear. Select one, and you see links to numerous Q&As on the current topic, with a link to the related forms and occasional expert tips (educational articles on the current topic).

Finally, click the chat icon in the lower right and the help pane explains the two types of professional help available. If you have questions about the site itself, like where to enter an item, you can call a specialist during the service's very generous business hours. Text chat is also available 24/7. If you have actual tax-related questions (Can I write this off? Do I qualify for this?), you can connect with a tax professional via chat ($39.99 for unlimited chats; screen-sharing available).

Review and File Your Tax Return

After you complete all of the federal tax steps, H&R Block Deluxe takes care of some additional tasks, such as creating estimated tax payment vouchers, and then provides a summary of your return. It also suggests forms you may have forgotten and lets you search for (and jump to) additional documents by form name or tax topic. This can be very helpful when you come to the end of your return and still have paper forms or unresolved issues.

Next up is the site's Accuracy Review, which combs your return for anything that may be inaccurate or missing. If it finds something, it explains the problem to you and provides a Fix Issue button, which takes you to the offending screen for corrections and then back to the list of issues. H&R Block has improved this feature since last year. It worked fine in my testing, though it only returned us to the exact page where the error occurred without isolating the precise field, as TurboTax does.

After that, it's on to your state return and e-filing the whole shebang.

The H&R Block Mobile Experience

H&R Block Tax Prep and File, the mobile version into of H&R Block's service, is available for both Android and iOS, and both apps are device-neutral. That is, you can access your return at any point through your desktop browser or tablet or smartphone by entering your user name and password. As we found last year, the apps, which look and work similarly, do a beautiful job of replicating the desktop experience. Both versions offer simple navigation, an able help system, and generous coverage of tax topics. While H&R Block's mobile versions are excellent, we did find that it required a bit more clicking than we'd have liked, however, and we found a minor interface glitch, too.

While H&R Block is tops on the desktop, the Intuit TurboTax Tax Return App is our favorite way to file your taxes on a mobile device, thanks to its top-notch interface and accessible, innovative help options.

A Reliable Option

H&R Block is a comprehensive, solid tax preparation website. Our own particular journey through the 1040 using H&R Block Deluxe went smoothly in testing, and we appreciate the changes made to the all-important help system. Whether you're a return H&R Block customer or are in the market for the first time, this service combines exceptional preparation tools and guidance, making it our 2019 PCMag Editors' Choice for online tax preparation services. It nudges out the also-excellent TurboTax, because of its better help and slightly lower pricing.

While you're thinking about last year's finances, you might also give some thought to the future. For your own money, you should read our roundup of the best personal finance software, and if you run a small business you might consider our overview of the best accounting software.

Bottom Line: H&R Block Deluxe is a comprehensive, easy-to-use tax service that helps e-filers claim relevant deductions and credits. The site is much improved, both in terms of the user experience and help options. It's our top choice for online tax preparation.

Please enable JavaScript to view the comments powered by Disqus.blog comments powered by

Please enable JavaScript to view the comments powered by Disqus.blog comments powered by